- Sector -2, B Block Noida-201301

- info@tradingshastra.com

Bull Call Spread Strategy: A Beginner-Friendly Options Approach

If you’re new to options trading or looking for a low-risk way to profit from a moderately bullish market, the bull call spread strategy could be your ideal starting point. This options strategy is simple, cost-effective, and reduces risk compared to buying calls outright. In this blog, we’ll break down everything you need to know about the bull call spread, its benefits, how it works, and how to implement it with confidence.

What is a Bull Call Spread?

A bull call spread is a type of vertical spread options strategy used when a trader expects a moderate rise in the price of the underlying asset. It involves buying one call option at a lower strike price and simultaneously selling another call option at a higher strike price. Both calls have the same expiration date.

This spread limits both your maximum profit and loss, making it a popular choice among conservative traders and beginners.

How the Bull Call Spread Option Strategy Works

Here’s a step-by-step breakdown of how this strategy is executed:

Buy a Call Option (Lower Strike Price)

This is your long position. It gives you the right to buy the stock at the lower strike price.Sell a Call Option (Higher Strike Price)

This is your short position. It caps your profit but also reduces the upfront cost.

✅ Example:

Stock: ABC Ltd trading at ₹100

Buy 1 Call: ₹95 strike price at ₹7 premium

Sell 1 Call: ₹105 strike price at ₹2 premium

Net Premium Paid = ₹7 – ₹2 = ₹5 per share

Maximum Profit = (₹105 – ₹95) – ₹5 = ₹5 per share

Maximum Loss = Net Premium Paid = ₹5 per share

When to Use the Bull Call Spread Strategy

You should use the bull call spread option strategy when:

You expect the stock to go up moderately, not aggressively.

You want to limit risk and don’t mind capping your profits.

You are trading with a small capital and prefer lower premium costs.

This makes it ideal for sideways-to-bullish market conditions.

Benefits of the Bull Call Spread

Let’s explore why traders love this strategy:

🔹 Limited Risk

You know the worst-case scenario right from the start. The maximum loss is limited to the net premium you pay.

🔹 Lower Cost Than Buying a Call

Buying a single call option can be expensive. By adding the short call, your net premium reduces, making this strategy more affordable.

🔹 Defined Profit Potential

Your maximum profit is limited but known in advance, which helps in planning and stress-free trading.

🔹 Works in Moderately Bullish Markets

Perfect for markets where you expect a gradual rise—not a sharp one.

Risks of a Bull Call Spread

Like any strategy, it has its downsides:

Capped Profit: You can’t benefit if the stock surges beyond your upper strike.

Time Decay (Theta): As expiry nears, the time value of your long call erodes.

Execution Costs: Buying and selling two options means paying more in brokerage and taxes.

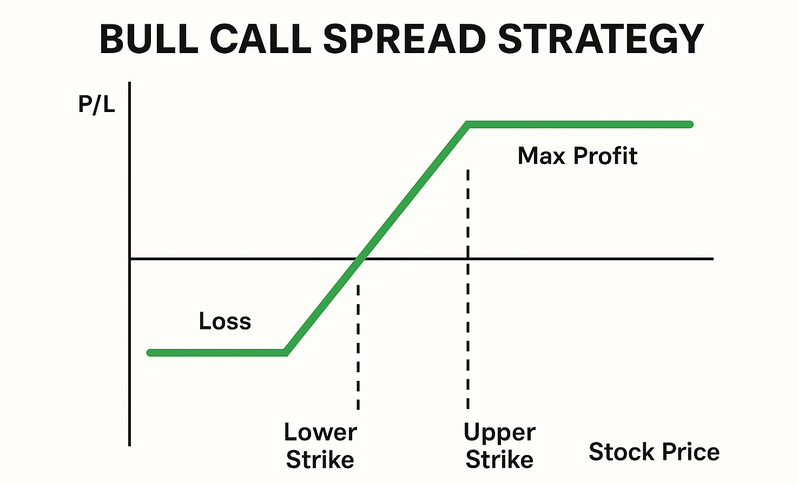

Payoff Chart of Bull Call Spread

Here’s a simple visualization of how your profit/loss looks at expiry:

Stock Price < Lower Strike → Loss = Net Premium Paid

Stock Price = Middle Range → Break-even at (Lower Strike + Net Premium)

Stock Price ≥ Upper Strike → Max Profit = Difference in Strikes – Net Premium

Bull Call Spread vs Buying a Call

| Criteria | Buying a Call | Bull Call Spread |

|---|---|---|

| Premium Paid | High | Lower |

| Risk | Limited to premium | Limited to net premium |

| Profit Potential | Unlimited | Limited |

| Best Market Scenario | Strongly bullish | Moderately bullish |

The bull call spread strategy is more capital-efficient and offers protection in case the market doesn’t move much.

Choosing Strike Prices

Success with this strategy depends on choosing the right strike prices:

Lower Strike (Buy Call): Choose near or slightly below the current market price.

Upper Strike (Sell Call): Pick a price target where you believe the stock may go.

Avoid too wide a spread; it increases risk with limited gain.

Real-World Example (Nifty Options)

Let’s say:

Nifty is trading at 22,000

Buy 22,000 CE at ₹180

Sell 22,200 CE at ₹80

Net Premium = ₹100

Max Profit = (22,200 – 22,000) – 100 = ₹100

Lot Size = 50

➡️ Max Loss = ₹5,000

➡️ Max Profit = ₹5,000

Your risk-reward is well balanced with limited exposure.

Is Bull Call Spread Good for Beginners?

Absolutely. The bull call spread option strategy is ideal for:

Beginners who want to reduce exposure

Small capital traders

Those learning how options spreads work

You get hands-on learning without risking too much capital.

Taxation on Bull Call Spread in India

Profits or losses from options trading (including spreads) fall under business income as per Indian taxation laws.

You can deduct brokerage and other trading-related expenses

Losses can be carried forward for 8 years

Always consult a CA or tax advisor to stay compliant.

Final Thoughts

The bull call spread, bull call spread strategy, and bull call spread option strategy offer a fantastic starting point for traders who expect a moderate rise in the market. With limited risk, lower costs, and clearly defined returns, this strategy provides a great blend of safety and profit potential—especially when trading in regulated markets like NSE under the oversight of SEBI, ensuring transparency and investor protection.

If you’re just starting out or looking to protect your capital while still aiming for gains, this could be the smart play to make. Don’t just trade—trade with strategy.

Disclaimer:

Trading involves inherent market risks. While Trading Shastra’s program offers 100% loss coverage on allocated capital, traders must follow program guidelines and risk management protocols. Past performance is not indicative of future results. Program terms and conditions apply.

Ready to Get Trading Capital Without Risk? Join India’s most comprehensive funded trading program with ₹50L capital and complete loss protection.

Trading Shastra Academy

B-11, Sector 2, Noida – 201301

Website: www.tradingshastra.com

Email: info@tradingshastra.com

Phone: +91 9717333901