- Sector -2, B Block Noida-201301

- info@tradingshastra.com

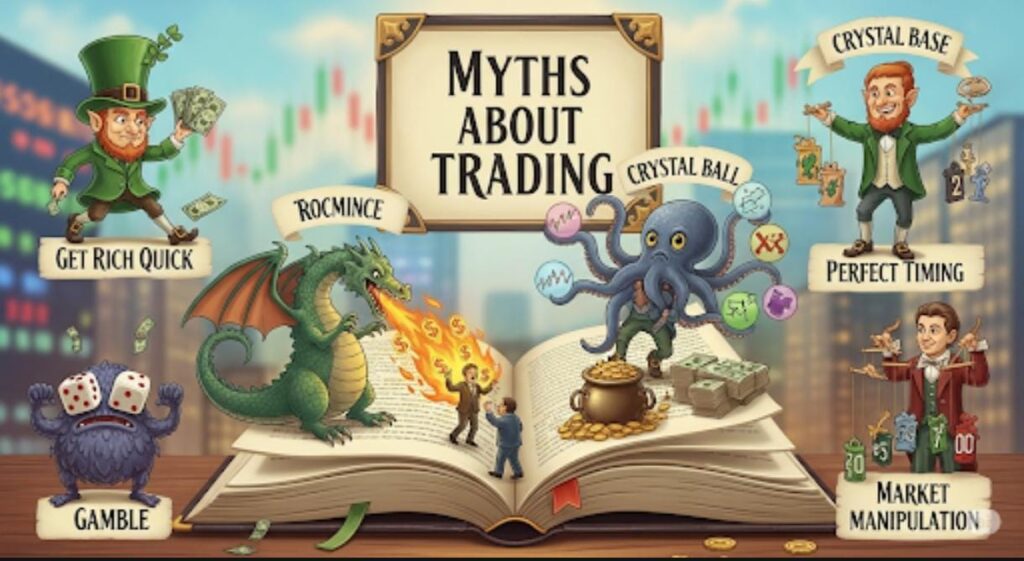

5 Biggest Myths About Trading | Debunked by Trading Shastra Experts

The world of trading is surrounded by numerous myths that prevent aspiring traders from achieving success. Many beginners believe these common myths about stock market activities without understanding the reality. At Trading Shastra, we encounter these misconceptions daily and believe that debunking these trading myths is essential for every aspiring trader’s journey. This article exposes the 5 biggest myths about trading that keep people from financial success.

Myth 1: Trading is Gambling

The Myth:

Many people believe trading is just like gambling – relying purely on luck and chance without any skill involved.

The Reality:

Trading is a skill-based profession that requires:

-

Technical and fundamental analysis

-

Risk management strategies

-

Psychological discipline

-

Continuous learning and adaptation

Unlike gambling, successful trading involves calculated decisions based on research and analysis. Professional traders at Trading Shastra treat it as a business, not a game of chance.

Myth 2: You Need Large Capital to Start

The Myth:

Many believe you need thousands of dollars to begin trading effectively.

The Reality:

You can start with surprisingly small amounts:

-

Many brokers offer zero minimum investment

-

Fractional shares allow small investments

-

Trading Shastra’s educational programs show how to start small

-

Proper risk management matters more than initial capital

The key is consistent growth through smart strategies, not large initial investments.

Myth 3: Trading Guarantees Quick Riches

The Myth:

The get-rich-quick mentality suggests trading can make you overnight millionaires.

The Reality:

Sustainable trading requires:

-

Years of learning and practice

-

Gradual account growth

-

Managing expectations

-

Understanding that losses are part of the process

Trading Shastra emphasizes that consistent profits come from discipline, not luck.

Myth 4: Complex Strategies Always Work Better

The Myth:

Beginners often believe complicated strategies with multiple indicators guarantee success.

The Reality:

Simple often works best:

-

Overcomplication leads to analysis paralysis

-

Clean charts with few indicators perform better

-

Trading Shastra teaches simplified, effective approaches

-

Mastery of basic strategies outperforms complex unmastered ones

The best trading strategies are often the simplest ones executed perfectly.

Myth 5: You Must Predict the Market Perfectly

The Myth:

Many believe successful trading requires perfect market predictions.

The Reality:

Professional trading involves:

-

Probability and risk management

-

Adapting to market conditions

-

Cutting losses quickly

-

Letting profits run

Trading Shastra teaches that profitability comes from risk management, not prediction.

Advanced Trading Myths Debunked

It’s not just beginners who fall for trading myths—sometimes even advanced traders hold on to misconceptions that can hurt their growth. Let’s break down a few of the most common advanced-level myths:

1. Myth: Advanced Indicators Guarantee Profits

Many traders believe that complex indicators like Elliott Waves or Harmonic patterns always give accurate signals. The reality is that no indicator is 100% foolproof. The best traders use them only for confirmation, not as the sole decision-making tool.

2. Myth: More Screen Time = More Profit

Spending the entire day watching charts doesn’t necessarily make you a better trader. In fact, over-trading and over-analysis often lead to losses. Successful traders focus only on high-probability setups rather than chasing every move.

3. Myth: Big Capital is a Must for Advanced Trading

Another common belief is that you need huge capital to succeed in advanced trading. In reality, with proper risk management and position sizing, even small capital can grow consistently. A Quora thread on this is worth checking: Can small capital traders succeed in stock markets?.

4. Myth: Professional Traders Don’t Lose

Even the best institutional and hedge fund traders face losses. The difference is that professionals accept losses as part of the process, cut them early, and stick to their system with discipline.

Why These Myths Persist

These trading myths continue because:

-

Social media promotes get-rich-quick stories

-

Movies and media sensationalize market success

-

Beginners seek easy solutions to complex challenges

-

Failure stories often go untold

How Trading Shastra Debunks These Myths

Our approach at Trading Shastra includes:

-

Realistic expectations setting

-

Comprehensive education programs

-

Live mentoring and support

-

Risk management focus

-

Psychological training

See More Blogs

Frequently Asked Questions (FAQs)

Q1: Are all trading myths completely false?

While most trading myths are exaggerations or misconceptions, some contain partial truths that are often misinterpreted by beginners.

Q2: How long does it take to become a successful trader?

Most traders require 1-3 years of consistent learning and practice to achieve sustainable success, depending on their dedication and learning approach.

Q3: Can anyone become a successful trader?

While anyone can learn trading, success requires specific psychological traits including discipline, patience, and emotional control that not everyone naturally possesses.

Q4: What’s the biggest danger of believing these myths?

These trading myths create unrealistic expectations that lead to impulsive decisions, excessive risk-taking, and ultimately account blowups.

Q5: How does Trading Shastra help avoid these misconceptions?

We provide reality-based education, live mentoring, and continuous support to ensure students develop realistic expectations and practical skills.

Disclaimer:

This article is for educational purposes only. Trading involves significant risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Consider consulting a qualified financial advisor before making any investment decisions.

Ready to Learn Reality-Based Trading? Join Trading Shastra’s comprehensive programs that focus on practical skills and realistic expectations.

Trading Shastra Academy

B-11, Sector 2, Noida – 201301

Website: www.tradingshastra.com

Email: info@tradingshastra.com

Phone: +91 9717333901

Hours: Monday – Saturday: 9:00 AM – 6:00 PM IST