- Sector -2, B Block Noida-201301

- info@tradingshastra.com

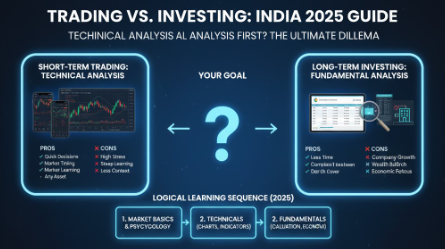

Technical Analysis vs Fundamental Analysis Course — Which One Should You Do First?

Technical Analysis studies price movements, charts, and indicators to identify trading opportunities based on market trends and psychology. Fundamental Analysis, on the other hand, evaluates a company’s financial health, earnings, and valuation to determine its real worth. Traders often combine both to make informed investment decisions.

What is Technical Analysis?

Technical analysis studies price movements, charts, and market patterns to predict future trends.

Instead of analyzing company balance sheets, it focuses purely on market psychology reflected in prices.

By studying indicators such as moving averages, RSI, and MACD, traders can identify when to enter or exit trades.

Chart patterns like double tops, flags, and trendlines help visualize how buyers and sellers behave in real time.

Technical analysis is ideal for:

Intraday traders, who buy and sell within the same day.

Swing traders, who hold trades for a few days or weeks.

Short-term participants, who want to time market entries precisely.

This approach helps traders act quickly, manage risk efficiently, and take advantage of short-term volatility.

What is Fundamental Analysis?

Fundamental analysis focuses on what the company is worth, rather than what the market currently prices it at.

It involves studying a company’s financial statements, earnings, industry position, and economic environment.

Key tools include:

Balance sheet and income statement study

Profitability ratios (like P/E, ROE, EPS)

Valuation metrics and growth potential

Fundamental analysis is better suited for:

Investors who prefer holding for months or years

Portfolio builders aiming for consistent long-term growth

Value seekers who want to find undervalued companies before others do

By mastering fundamentals, investors can identify strong businesses that create wealth over time — regardless of short-term market swings.

Technical Analysis vs Fundamental Analysis — Key Differences

Both methods serve unique but complementary purposes.

Technical analysis helps with timing and trade execution, while fundamental analysis supports long-term investment decisions.

Here’s a quick comparison for clarity:

| Factor | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price action, market trends, and charts | Company financials, intrinsic value |

| Timeframe | Short-term to medium-term | Long-term investment horizon |

| Tools Used | Indicators, patterns, oscillators | Balance sheets, earnings, ratios |

| Best For | Traders, active participants | Investors, wealth builders |

| Goal | Capture market momentum | Identify valuable businesses |

Most successful market professionals don’t choose one over the other — they combine both. Fundamentals identify what to buy; technicals decide when to buy.

Which Course Should You Do First?

If your primary interest lies in active trading, begin with technical analysis.

It teaches chart reading, momentum tracking, and timing — skills that deliver quicker practical understanding.

If your aim is long-term wealth creation or portfolio building, fundamental analysis should come first.

It helps you evaluate the quality and potential of companies before you invest.

Best learning path:

Start with technical basics for timing and psychology →

Then learn fundamentals for company selection and valuation.

This sequence ensures you can both trade tactically and invest strategically.

Smart Tip: Combine Both for Consistency

Many seasoned traders and investors use a hybrid approach.

They first shortlist fundamentally strong stocks and then use technical indicators to time their entry and exit points.

This combination helps balance conviction with precision — the ideal skill set for modern markets.

Why Taking a Structured Course Matters

Learning analysis from random sources can lead to confusion or half-baked understanding.

A structured, mentorship-based program provides clarity, sequence, and real-world context.

Under guided training, you learn:

How to read charts accurately

How to interpret financial data correctly

When to apply each type of analysis

How to combine them in live markets

At Trading Shastra Academy, learners receive practical exposure through live-market sessions, case studies, and interactive mentorship.

Courses such as the Supreme Trader Program and Ultra Supreme Program cover both analysis streams with risk management modules — helping learners grow with confidence and skill.

Conclusion

There’s no universal “first” — it depends on your goals.

For those wanting to trade actively, technical analysis is a logical starting point.

For those focused on long-term investing, fundamental analysis lays the right foundation.

However, combining both creates the complete skill set every successful market participant needs.

If you’re serious about developing this balance, Trading Shastra Academy offers the ideal environment — structured learning, guided mentorship, and real-market exposure.

FAQ

Q1. Should I learn technical analysis before fundamental analysis?

If your focus is trading actively, technical analysis should come first. But if your focus is long-term investing, fundamental analysis is the starting point.

Q2. Which is easier to learn: technical or fundamental analysis?

Technical analysis is quicker to grasp because it relies on charts and patterns. Fundamental analysis takes longer as it involves studying financials and valuations.

Q3. Can I learn both technical and fundamental analysis together?

Yes, you can learn both together, but sequencing helps. Start with technical basics for immediate practice, then expand into fundamentals for stock selection depth.

Q4. Which analysis is more profitable?

Profitability depends on style. Traders gain more from technical analysis for entries and exits, while investors gain more from fundamental analysis for long-term growth.

Q5. Where can I learn both in a structured way?

Trading Shastra Academy provides programs covering both technical and fundamental analysis. Students gain practical mentorship and live-market exposure, ensuring a balanced learning experience.

Trading Shastra Academy

B-11, Sector 2, Noida – 201301

Disclaimer:

This blog is for educational purposes only. Stock market investments are subject to market risks. Please do thorough research before investing.